| 02 February 2026-28 February 2026

USD & AUD Fixed Deposit Promotion – Branch Exclusive

| Fixed Deposit Promotion^ | Tenure | Promotional Interest Rate¹ | Minimum Deposit Amount |

|---|---|---|---|

| USD Fixed Deposit |

3 months 6 months 12 months |

3.65% p. a. 3.70% p. a. 3.40% p. a. |

USD $50,000 |

| AUD Fixed Deposit |

3 months 6 months 12 months |

3.50% p. a. 3.60% p. a. 3.70% p. a. |

AUD $50,000 |

^Available in branch only.

SGD Fresh Fund Fixed Deposit Promotion

|

Channel |

Promotional Rates¹ | Minimum Placement Amount | |

|---|---|---|---|

| 6 months | 12 months | ||

| Online* | 1.50% p.a. | 1.30% p.a. | S$10,000 |

| Branch | 1.45% p.a. | 1.25% p.a. | S$100,000 |

*Available on HLB Connect only.

¹The Promotional Rate(s) may be revised at the discretion of the Bank without prior notice. Call us to find out more: +65 6028 9800.

Place your SGD FD without visiting the bank!

Don't have a Fixed Deposit Account yet? Get started by opening an HL Bank iSavings Account online here via Singpass.

Once approved, log in to HLB Connect Online and follow these simple steps to make your first placement:

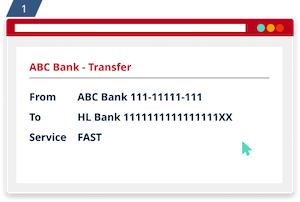

Transfer funds into your HL Bank Account using FAST

From the Pay & Transact menu, select New Placement

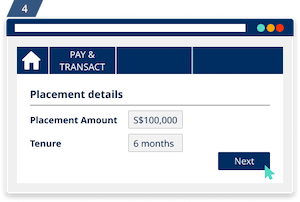

Enter your new placement details and click Next

Check and confirm your details and click Submit

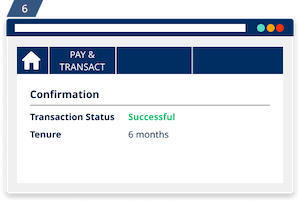

A Confirmation Page with transaction status will be shown

Terms & Conditions apply.

*Please note that Fixed Deposit placements which are accepted on Saturdays shall be value dated as of the next Business Day and Fixed Deposit withdrawals are unavailable on Saturdays.

Deposit Insurance Scheme ("DI Scheme")

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.