People like you were also interested in

Features & Benefits

Attractive Interest Rates

Enjoy higher interest on your savings

More details

Less details

Enjoy higher interest on your savings

More details

Less details

Flexible Choice of Tenors

Get started with a choice of tenor from 1 - 24 months

More details

Less details

Get started with a choice of tenor from 1 - 24 months

More details

Less details

Convenient Automatic Renewal

Enjoy the convenience of automatic renewal for your fixed deposit upon maturity, unless you provide us with alternative instructions at least 1 working day before the maturity

More details

Less details

Enjoy the convenience of automatic renewal for your fixed deposit upon maturity, unless you provide us with alternative instructions at least 1 working day before the maturity

More details

Less details

Online Application

Existing FD accountholders can place your Fixed Deposit online in a few clicks via HLB Connect Online Banking. Find out more here

More details

Less details

Existing FD accountholders can place your Fixed Deposit online in a few clicks via HLB Connect Online Banking. Find out more here

More details

Less details

Eligibility

- Minimum deposit of S$50,000 for 1 month placement and above

- Applicable for individual and non-individual customers, including sole proprietors, partnerships, clubs and associations

- For Singapore citizen, permanent residents and foreigners with valid documentation aged 18 years and above

- Account opening is subject to the Bank's approval

More details

Less details

- Minimum deposit of S$50,000 for 1 month placement and above

- Applicable for individual and non-individual customers, including sole proprietors, partnerships, clubs and associations

- For Singapore citizen, permanent residents and foreigners with valid documentation aged 18 years and above

- Account opening is subject to the Bank's approval

More details

Less details

Premature Withdrawals

Effective 2 January 2025, interest is not payable for any premature withdrawals of fixed deposit

More details

Less details

Effective 2 January 2025, interest is not payable for any premature withdrawals of fixed deposit

More details

Less details

| Tenor | Board Rates % (p.a.) |

|---|---|

| 1 MONTH | 0.100000 |

| 3 MONTHS | 0.200000 |

| 6 MONTHS | 0.300000 |

| 12 MONTHS | 0.400000 |

Make your first online placement with HLB Connect by following the steps below!

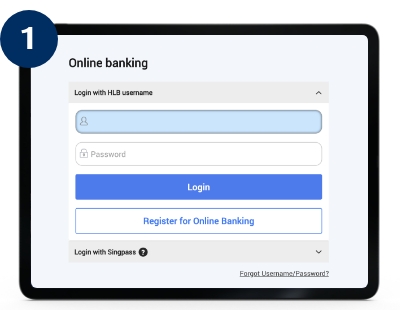

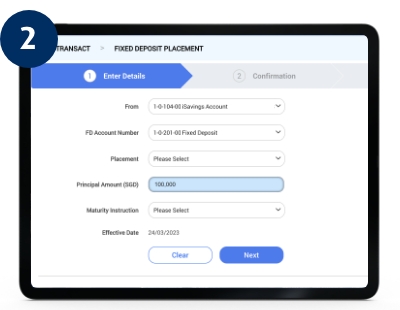

For individuals with an existing Fixed Deposit Account, just follow these 4 simple steps:

Make a Placement

Click on "Place New Fixed Deposit" on Pay & Transact, choose your preferred placement and click "Next".

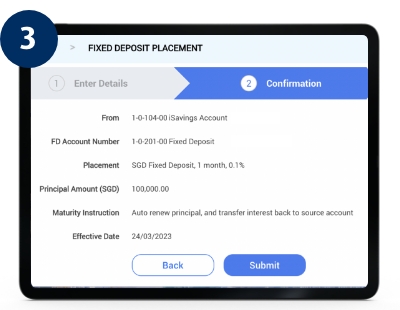

Confirm Details

Confirm your details and click "Submit".

Confirm Details

Confirm your details and click "Submit".

Confirm Details

Confirm your details and click "Submit".

Confirm Details

Confirm your details and click "Submit".

Confirm Details

Confirm your details and click "Submit".

Confirm Details

Confirm your details and click "Submit".

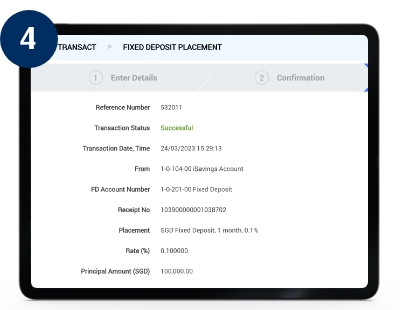

Successful Application

Once your application is successful. you will get

an acknowledgement receipt and you are done!

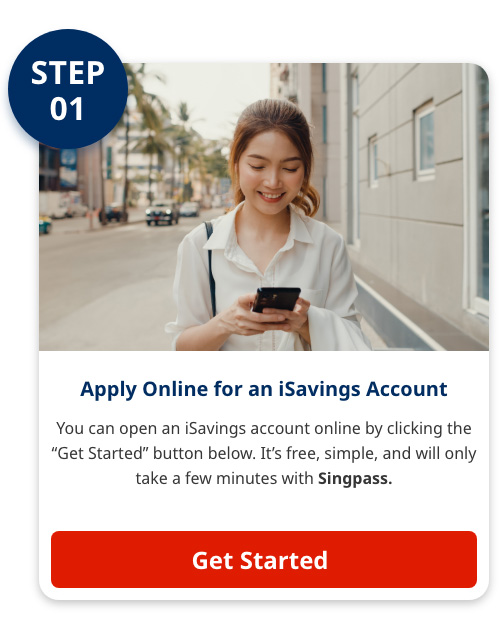

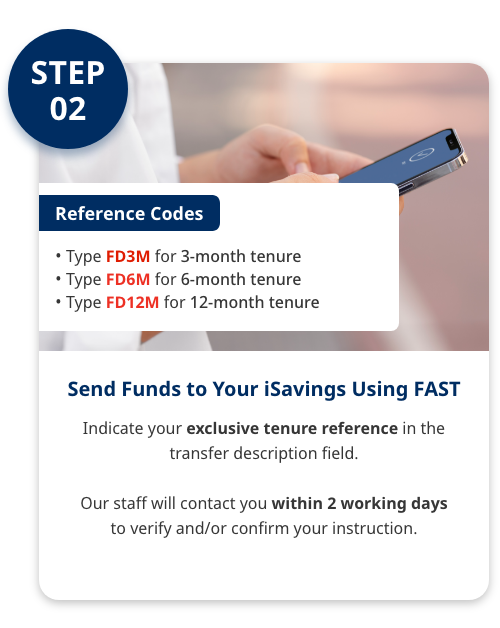

For individuals without a Fixed Deposit Account, get started and make your first placement in 2 simple steps :

Note:

1. Due to an increase in volume of applications, new applications may take longer time to be processed. Thank you for your understanding.

2. A minimum balance of S$5,000 is required for iSavings. Monthly service fee is waived for the first two months of Account Opening.

| Fees & Charges Description | Fees / Charges |

|---|---|

Fixed Deposit Placements via:

Inward Remittances (MEPS, Telegraphic Transfer)

|

Free

|

Fixed Deposit Withdrawals via:

Cashier's Order

MEPS

|

Free for first transaction, S$5 for subsequent transaction S$10

Free for first transaction

|

Note: The above fees are subject to review from time to time at the discretion of the Bank.

Terms & Conditions apply.

*Please note that Fixed Deposit placements which are accepted on Saturdays shall be value dated as of the next Business Day and Fixed Deposit withdrawals are unavailable on Saturdays.

Deposit Insurance Scheme ("DI Scheme")

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.