People like you were also interested in

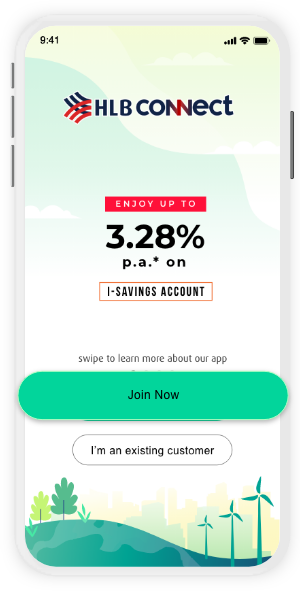

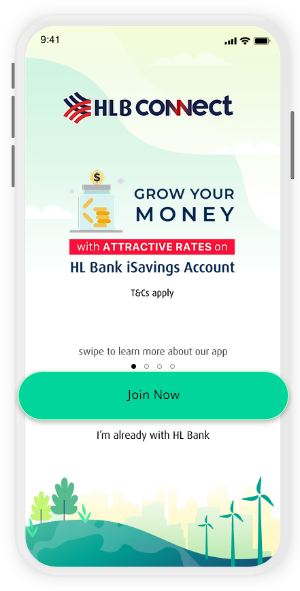

At HL Bank, we believe saving should be straightforward and rewarding. iSavings Account offers you competitive interest rates without the hassle of multiple conditions.

Thanks to overwhelming fan love, we’re bringing back the limited-edition Hello Kitty Game Sets with a brand-new collection that’s exclusively yours when you save with us. Don’t miss your chance to bring home these adorable collectibles.

Click here to find out more.

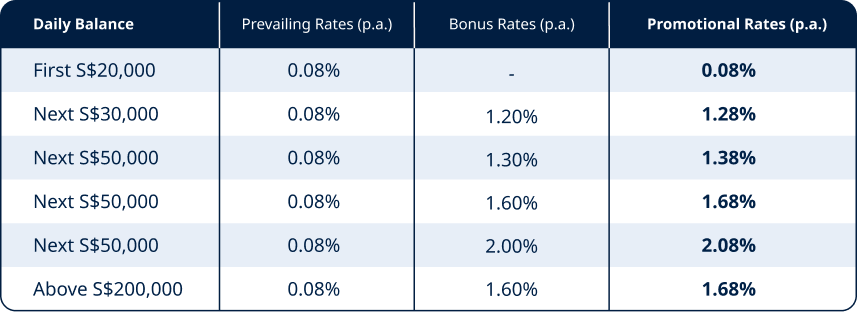

And that's not all - enjoy rewarding savings too:

Earn 1% p.a. on your first S$20,000 in your iSavings account

Boost your earnings up to 1.08% p.a. when you save more with in your iSavings account

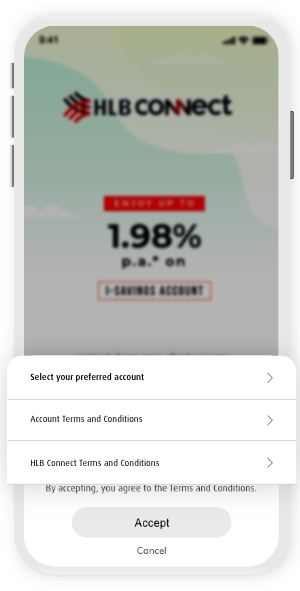

Balance over S$3 million will earn the prevailing rate of 0.08%p.a. Interest is calculated daily and credited monthly. The interest rate is effective 01 November 2025 and HL Bank reserves the right to revise these interest rates from time to time in its own absolute discretion.

Features & Benefits

Easy Access

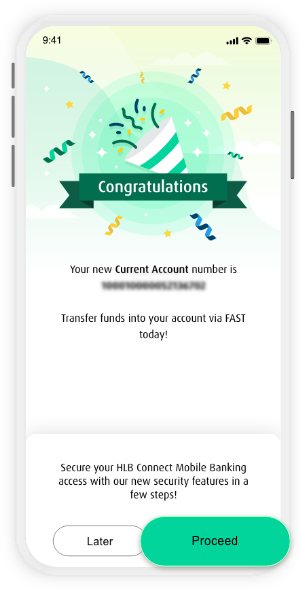

Manage your account through HL Bank Connect (for individuals) and keep track of your finances at your convenience.

More details

Less details

Monthly e-Statement

Keep track of your bank account with monthly e-statement that is encrypted and sent to you via email.

More details

Less details

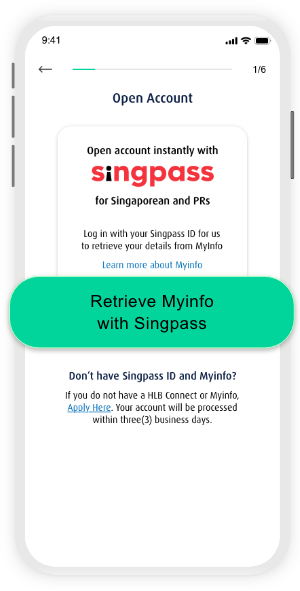

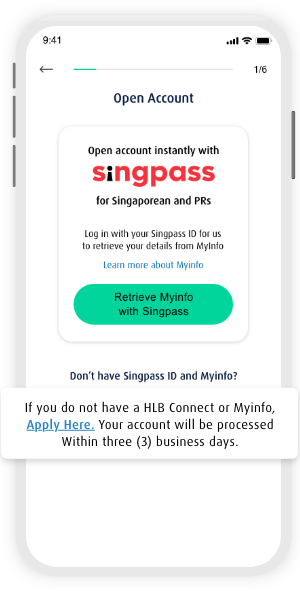

Eligibility

- Applicants must be 16 years old and above

- The account is available for individuals, either on a single or joint-name basis

- Each accountholder can have a maximum of one individual account and one joint account

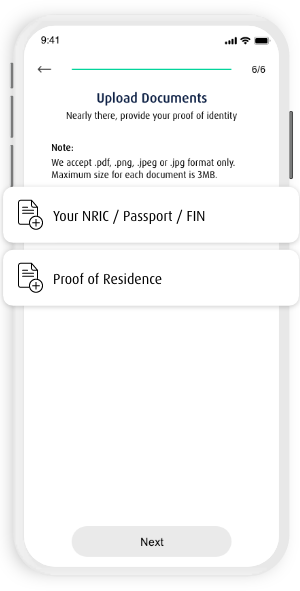

- The account is open to Singapore citizens, permanent residents, and foreigners with valid documentation

- Account opening is subject to the Bank’s approval

More details

Less details

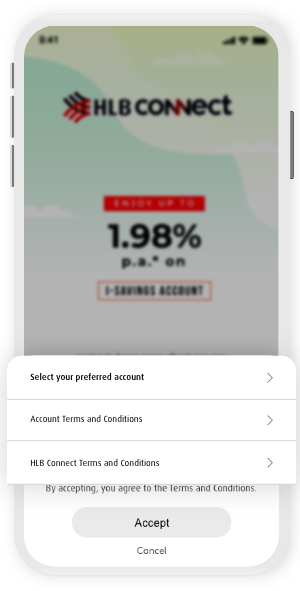

Terms and Conditions apply.

Deposit Insurance Scheme ("DI Scheme")

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporate, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

- Minimum Initial Deposit: S$1,000

- S$30 early closure fee if account is closed within 6 months of opening

- Fees and charges apply for over-the-counter transactions