People like you were also interested in

Features & Benefits

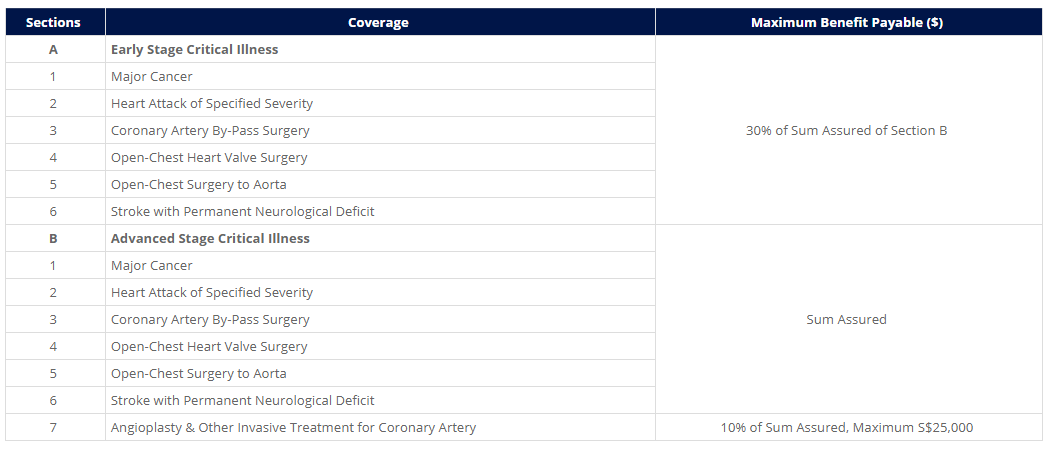

Get Covered from Early Stages

Provide financial support from stage 1 critical illness

With 30% acceleration payout for early-stage diagnosis on the covered Critical Illness, this will help to offset any medical or living expenses when you are recovering and safeguard your family from unexpected financial loss.

Coverage continues after Early Stage payout!

More details

Less details

Free Medical Teleconsultation

Get medical advice right at your home

Bringing clinics to you without stepping out of your house. Get access to medical consultation with a doctor via an app – it’s easy and convenient. Get onto our Prestige Program and enjoy the perks.

More details

Less details

Immediate Coverage

No medical examination required

Just take 5 minutes to answer 5 Health Declaration Questions to get yourself covered. No hassle of medical examination required and you can get coverage immediately.

More details

Less details

Learn more about the coverage

Disclaimers

Early Protect360 is underwritten by HL Assurance Pte. Ltd. (“HL Assurance”) and distributed by HL Bank Singapore (“HL Bank”). It is not an obligation of, deposit in or guaranteed by HL Bank. This is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy wordings and will be sent to you upon acceptance of your application by HL Assurance.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance or visit the General Insurance Association or SDIC websites.

Disclaimers

Car Protect360 is underwritten by HL Assurance Pte. Ltd. (“HL Assurance”) and distributed by HL Bank Singapore (“HL Bank”). It is not an obligation of, deposit in or guaranteed by HL Bank. This is not a contract of insurance. Full details of the terms, conditions and exclusions of the insurance are provided in the policy wordings and will be sent to you upon acceptance of your application by HL Assurance.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance or visit the General Insurance Association or SDIC websites.

Requirements:

- You must be between the age of 18 to 65 years old.

- You must be a Singapore Citizen, Singapore Permanent resident or a foreigner holding a valid pass issued by Singapore government and is residing in Singapore.

Find out more about Early Protect360 FAQs here.